‘Confused’ Pension Savers Plead For No More Changes

On the second anniversary of the pension freedom reforms, retirement savers say they are confused by the rules and want no more changes, according to new independent research1 from Prudential.

Two out of three over-55s (67 per cent) – the age from which retirement savers can utilise the new rules – say they are confused by the reforms launched in April 2015. More than three-quarters (77 per cent) want an end to any further changes to pension rules, and more than four out of ten (42%) say the continual changes to pensions has made them switch off from the topic.

Government figures2 demonstrate the cost of this confusion for retirement savers as tax bills related to the pensions freedoms are now greater than anticipated. It was initially estimated that the changes would mean a total of £900 million being paid in the tax years 2015-16 and 2016. In fact, a total of £2.6 billion in tax is now expected to be paid.

The new freedoms are having an impact in other ways. Nearly one in ten (9 per cent) over-55s say they have made changes to their retirement plans as a result of the reforms. Interest in receiving financial advice has been increasing with a fifth of retirement savers (21 per cent) saying they are taking financial advice, while a further 9 per cent either planning to or have done so for the first time.

Those surveyed believe that additional support for savers in terms of advice and guidance would encourage them to save more – 36 per cent say walk-in financial guidance centres would boost saving while nearly a third (31 per cent) would back a tax break for savers taking face-to-face professional financial advice.

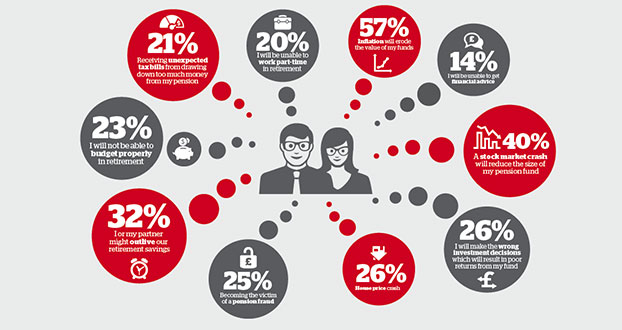

However, concerns that pension rules may change again in the future persist, with 81 per cent of over-55s worried that the State Pension might be reduced and 57 per cent concerned it will be abolished. Nearly two out of three (63 per cent) also believe that tax relief on pension contributions will be reduced at some time in the future.

Vince Smith-Hughes, retirement income expert at Prudential, said:

“Nearly 550,000 people have accessed more than £9.2 billion in funds since the launch of pension freedoms3, demonstrating that there is popular demand for the increased flexibility brought about by the reforms.

“However, two years on from the introduction of the new rules there is also widespread confusion with two out of three over-55s admitting they don’t fully understand the reforms. This lack of understanding may be a contributing factor in pension-related tax paid to the Treasury being higher than originally expected.

“That underlines the importance of advice and guidance in ensuring that the pension freedoms are a long-term success and it is encouraging that many savers recognise how advice can help them to make the most of their retirement pot.

“The pension freedoms provide a framework of rules but it is down to individuals to seek help where needed to enable them to plan how to meet their financial goals. Saving as much as possible as early as possible during your working life is the first step towards having sufficient income for a happy retirement.”

The Prudential research found that over-55s would value support from their employers in tackling retirement planning. About 21 per cent say access to financial advice at work would help them save more, while 20 per cent would back having retirement planning seminars at work.

1 Consumer Intelligence conducted research on behalf of Prudential between 17th and 24th February 2017 among a nationally representative sample of 867 people aged 55-plus

2 https://www.gov.uk/government/publications/spring-budget-2017-documents

https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/597335/PU2055_Spring_Budget_2017_web_2.pdf

3 https://www.gov.uk/government/statistics/flexible-payments-from-pensions