UK Savings Rates To Continue To Fall Despite Auto-Enrolment

The International Longevity Centre – UK (ILC-UK) are today announcing plans to explore the case for a second Independent Pensions Commission. The announcement comes as they release analysis of OBR projections which reveals that rising public and private debt poses risk to long term saving rates.

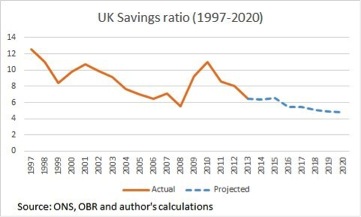

ILC-UK project that despite auto-enrolment, the savings ratio is likely to continue to fall up until 2020, posing significant risk to long term retirement incomes.

With the support of Prudential, ILC-UK will work over the next month to consider whether there is a case for a second Pension Commission, and if so, what it should focus on. ILC-UK will launch a report in London on 23rd February.

In the ten years since the first Pensions Commission we have witnessed significant policy changes including:

- Auto-enrolment and introduction of NEST.

- Changes to State Pension age.

- Changes to State Pension entitlements.

- Liberalisation of the decumulation market.

- Changes to public sector pension arrangements.

- End of default retirement age.

- Introduction of legislation to facilitate CDC pension schemes.

Until recently many of the changes have been introduced through a spirit of consensus.

Over the next month, ILC-UK will explore:

- The economic environment for growing personal savings in the UK

- The extent to which people are working longer

- Continuing increases in life expectancy

- Future sustainability of age-related spending by the Government

- What should a new Pensions Commission look like

Launching the project, Ben Franklin of ILC-UK said

“We face a perfect storm of stagnant income growth, low investment returns and a consumption driven economic recovery. Increasing savings levels are going to be tough. Now is the time to explore whether we need a second Independent Pensions Commission to help direct Government policy for the next ten years.”

Tim Fassam, Head of Public Affairs at Prudential added:

“Recent changes have expanded the number of people saving and provided a wider range of choices in retirement. While these are important improvements, most people are still not saving enough to provide the retirement they desire. Pension decisions are long-term, so stability and predictability are important in encouraging people to save more. At Prudential we believe the best way to achieve this is through consensus with savers, policymakers and industry working together.”