Private Sector Interest Returns As Extra Care Housing Takes Off

A renewed confidence among private sector developers, and a growing demand from potential leaseholders, looks set to support growth in the number of privately-owned extra care housing units opening across the UK, according to the latest research published by healthcare experts LaingBuisson.

Extra care housing, or retirement housing with integrated care, could be on the point of major expansion thanks to the alignment of a number of supporting factors, as reported in the latest edition of LaingBuisson’s Extra Care Housing UK Market Report.

While the voluntary sector continued to develop extra care schemes for rental after the financial crash and housing recession, the development of leasehold housing with care slowed. This was not helped by the government ending the highly praised Extra Care Housing Fund in 2010, which funded many mixed-tenure schemes. By 2013, however, the number of leasehold units opening was recovering, has been increasing since then and a record number of such units is expected to open in the coming year.

This step up in creation is in part down to the resurrection of state funding via the Care and Support Specialised Housing Fund which distributed some £100 million in July 2013, with a further £120 million having been bid for in February 2015 (with successful projects required to be live by spring 2018). However, there is also a revised interest from purely private developers for whom a number of factors have in recent years come together to generate a clearer business case in this specialist model of care housing.

As laid out in the report, factors which are in the market’s favour include:

• Increased investor money waiting to be invested in the sector

• Growing awareness of the model among older people and their relations

• Government planning policy, and planners, increasingly recognising the need to address housing for older people

• Regulatory/consumer protection issues around retirement housing are close to being resolved

• General housing market recovery which can oil the leasehold market.

Launching the report author and LaingBuisson associate, Philip Mickelborough, said: ‘Examples such as Rangeford Holdings and its partnership with the major investment group Octopus Healthcare are proof that there could be significant capital ploughed into UK retirement and older care in the coming years. The industry still awaits a definitive decision on the OFT study into exit fees, but once this is done we are likely to see a quick influx of funding.’

Although focused primarily on extra care housing, LaingBuisson’s study also looks at related forms of housing, analysing the ways in which extra care is indirectly regulated and considering the factors that will influence demand for the service.

It also reviews the various funding streams that make it possible to build and operate extra care housing – and whether this money is set to increase in coming years as a baby boomer audience approaching old age increasingly identifies the services afforded by extra care as the ways in which they would choose to be supported in later life.

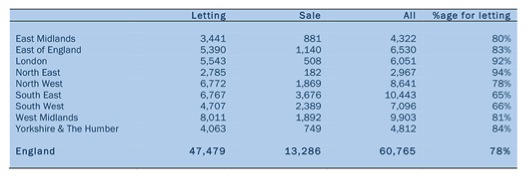

Table 1 Housing with care for older people by region and tenure in England, 2015