Number Of Over-45s Who Believe The State Will Pay For Care Hits Record Low!

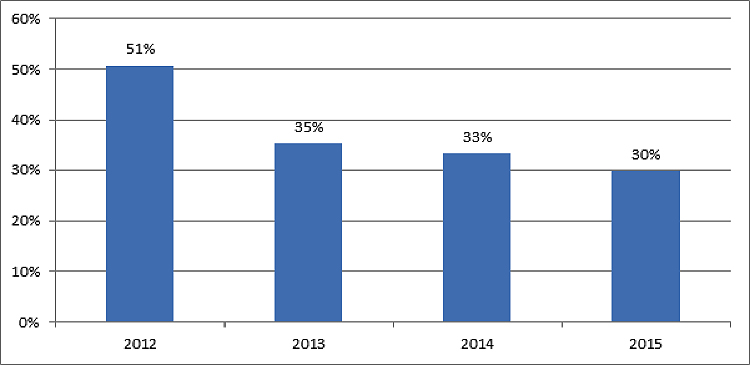

Just 30% of over-45s believe that the state will pay for their care suggests the fourth Partnership Care Index with a dramatic collapse in confidence from over 50% in 2012.. This is the lowest level in the last four years and suggests that while there is widespread confusion; people are becoming increasingly aware of their responsibilities.

Since 2012, expected reliance on local government funding has fallen across all age groups (see full table below) with the largest decrease recorded amongst the over-75s (44% – 2012 vs 12% – 2015).

Proportion of Over-45s who expect the State to Pay for Care:

Rather than relying on state support, people intend to sell their home (31%), use pension income (29%), raid their savings (28%) or rely on income from savings and investments (11%). However, while some have a clear idea on how they might meet these obligations, the number of people who don’t know by what means they will manage this expense has increased from 4% (2013) to 27% (2015).

Not only were they unsure as to how they might meet this cost but the proportion of people who did not know who to ask has also reached a four year high (18%). Others suggested they might find out about funding by speaking to their social worker or local authority (49%), Citizens Advice Bureau (42%), doctor (28%) or searching online (24%).

Sadly, the profession that is arguably most qualified to provide information as they are able to make concrete recommendations about care funding solutions – independent financial adviser (9%) – was a less popular option.

Jim Boyd, Director of Corporate Affairs, Partnership said:

“It is clear that discussions following the Social Care White Paper in 2012 have gradually seen people waking up to the fact that they will need to take responsibility for paying for their own care. However, while there is increased understanding, there also appears to be growing concern with a quarter of people having no idea how they will be able to meet this cost and one in five unsure how to access information.

“With the typical care home in England costing £29,558 per year, this is a significant amount of money to find for an indefinite period without any prior planning or knowledge. So it is vital that industry and local authorities take the opportunity presented by this interest to inform and educate people about their options.

“Highlighting that there are regulated independent financial advisers who specialise in this arena as well as products such as care annuities which provide peace of mind will help people to overcome their concerns and take concrete steps.”

Care sector calls for `care crisis’ talks with Treasury and other Whitehall Departments